Remote Finance Jobs in South Africa [An Overview]

This article explores the landscape and opportunities for remote finance jobs in South Africa.

![Remote Finance Jobs in South Africa [An Overview]](/blog/content/images/size/w2000/2025/12/remote-finance-jobs-in-south-africa.png)

Financial services have been described as the cornerstone of South Africa's economic architecture. The industry is a major GDP contributor (22% in 2023, the largest by any sector in the economy). It provides direct and indirect employment to nearly 3 million South Africans and contributes about 25% of corporate income tax revenues.

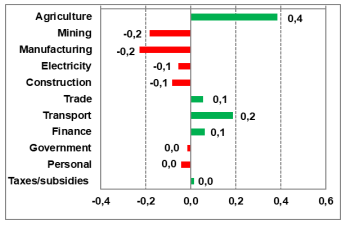

More recently, finance ranked as one of four industries that recorded positive growth between Q4 2024 and Q1 2025 (as shown in the diagram below).

Key Characteristics of South Africa's Finance Industry

South Africa's finance industry is Africa's most developed. Despite domestic economic challenges like power supply issues, the sector has continued on a growth trajectory and evolved distinctive strengths that set it apart locally, across Africa and beyond. The following key characteristics highlight the features that define this important industry:

Well-Developed, Diversified and Globally Integrated

South Africa’s finance industry is highly developed, diversified (includes banking, insurance, asset management, private equity, and microfinance) and globally connected. This international integration strengthens trade, investment, and capital flows. The Johannesburg Stock Exchange (JSE) is Africa’s largest and most liquid exchange, with over R20 trillion in market capitalisation.

Strong and Stable Banking System

The country’s banking sector is robust and well-capitalised, led by major institutions such as Standard Bank, FirstRand, Absa, and Nedbank. These banks follow international regulatory standards and provide advanced digital banking services that enhance efficiency and security.

Rapid Growth in Financial Technology (FinTech)

FinTech is a major driver of innovation, with significant growth in mobile payments, digital lending, and online platforms. Cape Town and Johannesburg have emerged as leading African FinTech hubs, accelerating digital transformation in financial services.

Transparent and Comprehensive Regulation

The finance industry is regulated by bodies including the South African Reserve Bank (SARB), the Financial Sector Conduct Authority (FSCA), and the National Credit Regulator (NCR). This sound regulatory environment ensures consumer protection, market stability, and responsible innovation.

Strong Insurance Industry

The country hosts many of Africa’s largest insurers and asset managers, contributing to a broad and competitive financial market. The insurance industry boasts exceptionally high life insurance penetration. The non-life insurance market is also mature and competitive, offering extensive protection options for individuals and businesses.

Regional Financial Hub

Thanks to its sophistication and stability, South Africa serves as a financial gateway to sub-Saharan Africa. Many international companies choose Johannesburg or Cape Town as their regional headquarters to access broader African markets.

Focus on Transformation and Financial Inclusion

The industry is committed to socioeconomic transformation, including through the government's Broad-Based Black Economic Empowerment (B-BBEE) policy. Efforts to improve financial inclusion and extend services to underserved populations remain key priorities.

Role-Specific Skills for Finance Industry Remote Work

To perform effectively, industry professionals must develop specialised capabilities across various areas, each with its own set of advanced sub-skills essential for modern finance functions. Here are some of such skill areas and examples of the sub-skills under them:

Treasury Management

- Liquidity planning

- Cash pooling across global entities

- Managing banking relationships remotely

- FX hedging strategies

International Tax & Transfer Pricing

- Cross-border tax structures

- Transfer pricing documentation

- Local country filing requirements

Revenue Operations (RevOps) & Subscription Finance

- SaaS revenue recognition (e.g., ASC 606 and IFRS 15)

- Customer lifetime value (CLV) modelling

- Churn analysis and ARR/MRR tracking

Capital Markets & Fundraising

- Debt financing, equity raises

- Cap table modelling

- Investor relations & pitch deck financials.

Financial Risk Modelling

- Value-at-Risk (VaR)

- Stress testing & scenario analysis

- Credit risk scoring models

ESG & Sustainability Finance

- Carbon accounting

- ESG reporting frameworks (e,g, GRI, SASB, and TCFD)

- Impact investment analysis

Mergers & Acquisitions (M&A)

- Due diligence

- Synergy modeling

- Post-merger integration planning

Actuarial & Insurance Finance

- Loss modeling

- Reserving methods

- Pricing risk for insurance products

Portfolio Management & Asset Allocation

- Portfolio optimisation

- Performance attribution

- Multi-asset investment strategies

Cost Accounting & Operations Finance

- Standard costing

- Inventory valuation

- Manufacturing variance analysis

Compliance & Internal Controls

- Internal auditing

- Fraud prevention systems

- Internal control design for remote workflows

Quantitative Finance & Algorithmic Modelling

- Time-series forecasting

- Risk modelling & back-testing frameworks

- Statistical arbitrage strategy development

Blockchain, Crypto & Digital Asset Finance

- Token valuation models

- On-chain analytics

- Crypto accounting

Essential Soft Skills

- Communication

- Attention to detail

- Time management

- Analytical thinking

- Problem-solving

- Collaboration & virtual teamwork

- Adaptability

- Ethical judgment

- Client relationship management

- Digital literacy

Remote Finance Jobs in South Africa

You can check out remote finance jobs in South Africa for some of the most recent finance industry remote jobs in South Africa.

Remote4Africa also features jobs for southern African countries, such as Zimbabwe, Zambia, Botswana, Angola, Lesotho, Malawi, Mozambique, Namibia, and Swaziland.